Wonderful 2019 by CTASaham & CTAFX Gold. Happy New Year, May Success Be With Us All. Get ready for Volatile January 2020.

Virus Selloff in Indonesian Equities Seen as Temporary: Mirae

Virus Corona Makin Brutal, Hari Sesi I IHSG Jatuh 0,99%

https://www.cnbcindonesia.com/market/20200128122725-17-133321/virus-corona-makin-brutal-hari-sesi-i-ihsg-jatuh-099

JPMorgan Says Stock Sell-Off Can Offer Chance to Add Shares

https://www.bloomberg.com/news/articles/2020-01-27/jpmorgan-says-virus-sell-off-could-offer-a-chance-to-buy-stocks?cmpid%3D=socialflow-twitter-markets&utm_content=markets&utm_medium=social&utm_source=twitter&utm_campaign=socialflow-organic

Opinion: Three reasons coronavirus won’t derail China’s economyhttps://www.marketwatch.com/story/three-reasons-coronavirus-wont-derail-chinas-economy-2020-01-27?mod=home-page&link=sfmw_tw

Masuk Indeks Lq45 Begini Kinerja Saham ACES TBIG TOWR

https://www.cnbcindonesia.com/

Week Ahead: Virus-Driven Selloff Likely Overdone, But Deeper Correction Eyed

https://www.investing.com/analysis/week-ahead-virusdriven-selloff-likely-overdone-but-deeper-correction-eyed-200501619

Commodities Week Ahead: Oil On The Ropes; Gold Eyes $1,600

https://www.investing.com/analysis/commodities-week-ahead-oil-on-the-ropes-gold-eyes-1600-200501668

3 Stocks To Watch In The Coming Week: Apple, Facebook, Microsoft

https://www.investing.com/analysis/3-stocks-to-watch-in-the-coming-week-apple-facebook-microsoft-200501616

Harga CPO langsung ambruk 5% selepas libur Tahun Baru Imlek

https://investasi.kontan.co.id/news/harga-cpo-langsung-ambruk-5-selepas-libur-tahun-baru-imlek

Reksadana Emco bermasalah, manager investasi lain masih optimistis

https://investasi.kontan.co.id/news/reksadana-emco-bermasalah-manager-investasi-lain-masih-optimistis

Depak INDY, MEDC dan TPIA, ini susunan baru penghuni saham LQ45

Sentimen virus Corona tekan proyeksi IHSG awal pekan https://www.cnnindonesia.com/ekonomi/20200127063316-92-468883/sentimen-virus-corona-tekan-proyeksi-ihsg-di-awal-pekan Corona Bikin Gerak IHSG Terbatas, Deretan Saham Ini Bisa Cuan

https://www.cnbcindonesia.com/market/20200127122802-17-132983/corona-bikin-gerak-ihsg-terbatas-deretan-saham-ini-bisa-cuan https://t.co/HXq29i3btA?amp=1 Waspada bad astrocycle di IHSG (sejak warning CTA 14 Jan) & indeks saham global, masih berlanjut di pekan ini.

Prospektifkah Mengoleksi Saham Lapis Tiga?

https://market.bisnis.com/read/20200124/7/1193651/prospektifkah-mengoleksi-saham-lapis-tiga?utm_source=dlvr.it&utm_medium=twitter

IHSG Zona Merah, INDO Pimpin Saham Tercuan

https://investor.id/market-and-corporate/ihsg-zona-merah-indo-pimpin-saham-tercuan

Virus Corona & RDG BI Bikin IHSG Menyerah di Akhir Pekan

https://www.cnbcindonesia.com/market/20200124162208-17-132555/virus-corona-rdg-bi-bikin-ihsg-menyerah-di-akhir-pekan?utm_source=twitter&utm_medium=oa&utm_campaign=cnbcsocmed

Bank Rakyat Indonesia Cut to Neutral at RHB Research Institute

(Bloomberg) -- RHB analyst Christopher Benas cut the recommendation on Bank Rakyat Indonesia Persero Tbk PT to neutral from buy.

PT set to IDR5,000, implies a 5.5% increase from last price. Bank Rakyat Indonesia average PT is IDR4,720.11.

Targets range from IDR3,600 to IDR5,500

Bank Rakyat Indonesia had 22 buys, 6 holds, 2 sells previously: Bloomberg data

Bank Rakyat Indonesia Cut to Hold at Ciptadana; PT IDR5,100

Laba Bank Mandiri Tembus Rp 27,5 T di 2019, Naik 9,9%

https://www.cnbcindonesia.com/market/20200124084957-17-132373/laba-bank-mandiri-tembus-rp-275-t-di-2019-naik-99

Reli Berlanjut, Secara Teknikal Kemana Arah Harga Batu Bara?

https://www.cnbcindonesia.com/market/20180918191107-17-33725/reli-berlanjut-secara-teknikal-kemana-arah-harga-batu-bara

Shio apa yang paling beruntung di Tahun Tikus? Simak peruntungannya

https://lifestyle.kontan.co.id/news/shio-apa-yang-paling-beruntung-di-tahun-tikus-simak-peruntungannya

Perdagangan Lima Saham Ini Disetop Gara-Gara Kasus Jiwasraya

https://insight.kontan.co.id/news/perdagangan-lima-saham-ini-disetop-gara-gara-kasus-jiwasraya

IHSG bangkit, cek PER dan PBV saham yang melejit, Kamis (23/1)

https://investasi.kontan.co.id/news/ihsg-bangkit-cek-per-dan-pbv-saham-yang-melejit-kamis-231

Peternak ayam dan perusahaan poultry atur harga, begini kesepakatannya

https://investasi.kontan.co.id/news/peternak-ayam-dan-perusahaan-poultry-atur-harga-begini-kesepakatannya

(Bloomberg) -- The coronavirus selloff in Indonesian equities will be temporary, providing an opportunity for investors to accumulate shares, says Mirae Asset Sekuritas.

- Jakarta Composite Index correction lasted for less than a month during 2002-2003 SARS epidemic, analysts Hariyanto Wijaya and Emma A. Fauni write in Jan. 29 report

- Continuation of foreign net buying of Indonesian stocks should support recovery of the benchmark gauge

- Foreign investors’ net buy at $150m YTD

- Govt has taken preventive measures, and country is free from coronavirus as of today

- Monthly top picks for January remain Bank Central Asia, Unilever Indonesia, Indofood Sukses Makmur, Japfa Comfeed Indonesia, Mitra Adiperkasa, Indo Tambangraya Megah, Aneka Tambang and Wijaya Karya

Virus Corona Makin Brutal, Hari Sesi I IHSG Jatuh 0,99%

https://www.cnbcindonesia.com/market/20200128122725-17-133321/virus-corona-makin-brutal-hari-sesi-i-ihsg-jatuh-099

Indonesia Readies Plan to Save Scandal-Hit Insurer From Collapse

JPMorgan Says Stock Sell-Off Can Offer Chance to Add Shares

https://www.bloomberg.com/news/articles/2020-01-27/jpmorgan-says-virus-sell-off-could-offer-a-chance-to-buy-stocks?cmpid%3D=socialflow-twitter-markets&utm_content=markets&utm_medium=social&utm_source=twitter&utm_campaign=socialflow-organic

Opinion: Three reasons coronavirus won’t derail China’s economyhttps://www.marketwatch.com/story/three-reasons-coronavirus-wont-derail-chinas-economy-2020-01-27?mod=home-page&link=sfmw_tw

Masuk Indeks Lq45 Begini Kinerja Saham ACES TBIG TOWR

https://www.cnbcindonesia.com/

BOS BEI: resiko virus Corona bersifat jangka pendek

Week Ahead: Virus-Driven Selloff Likely Overdone, But Deeper Correction Eyed

https://www.investing.com/analysis/week-ahead-virusdriven-selloff-likely-overdone-but-deeper-correction-eyed-200501619

Commodities Week Ahead: Oil On The Ropes; Gold Eyes $1,600

https://www.investing.com/analysis/commodities-week-ahead-oil-on-the-ropes-gold-eyes-1600-200501668

3 Stocks To Watch In The Coming Week: Apple, Facebook, Microsoft

https://www.investing.com/analysis/3-stocks-to-watch-in-the-coming-week-apple-facebook-microsoft-200501616

Harga CPO langsung ambruk 5% selepas libur Tahun Baru Imlek

https://investasi.kontan.co.id/news/harga-cpo-langsung-ambruk-5-selepas-libur-tahun-baru-imlek

Reksadana Emco bermasalah, manager investasi lain masih optimistis

https://investasi.kontan.co.id/news/reksadana-emco-bermasalah-manager-investasi-lain-masih-optimistis

Depak INDY, MEDC dan TPIA, ini susunan baru penghuni saham LQ45

Sentimen virus Corona tekan proyeksi IHSG awal pekan https://www.cnnindonesia.com/ekonomi/20200127063316-92-468883/sentimen-virus-corona-tekan-proyeksi-ihsg-di-awal-pekan Corona Bikin Gerak IHSG Terbatas, Deretan Saham Ini Bisa Cuan

https://www.cnbcindonesia.com/market/20200127122802-17-132983/corona-bikin-gerak-ihsg-terbatas-deretan-saham-ini-bisa-cuan https://t.co/HXq29i3btA?amp=1 Waspada bad astrocycle di IHSG (sejak warning CTA 14 Jan) & indeks saham global, masih berlanjut di pekan ini.

Hitung Dampak Aturan PSAK 72 Bagi Kinerja Emiten Properti

https://www.cnbcindonesia.com/market/20200127103243-19-132902/hitung-dampak-aturan-psak-72-bagi-kinerja-emiten-properti?utm_source=twitter&utm_medium=oa&utm_campaign=cnbcsocmed

Gas Negara PT Lowered 11% at CGS-CIMB Amid Tax Penalty Concerns

Gas Negara PT Lowered 11% at CGS-CIMB Amid Tax Penalty Concerns

(Bloomberg) -- Supreme court ruling on Perusahaan Gas Negara’s subsidiary will result in $255 million decline in its cash balance by the end of 2020, according to CGS-CIMB Sekuritas Indonesia.

- PT lowered to 2,050 rupiah from 2,300 rupiah with hold recommendation maintained, analyst Aurelia Barus writes in report

- NOTE: Link to Co’s disclosure on tax ruling, click here

Prospektifkah Mengoleksi Saham Lapis Tiga?

https://market.bisnis.com/read/20200124/7/1193651/prospektifkah-mengoleksi-saham-lapis-tiga?utm_source=dlvr.it&utm_medium=twitter

IHSG Zona Merah, INDO Pimpin Saham Tercuan

https://investor.id/market-and-corporate/ihsg-zona-merah-indo-pimpin-saham-tercuan

Virus Corona & RDG BI Bikin IHSG Menyerah di Akhir Pekan

https://www.cnbcindonesia.com/market/20200124162208-17-132555/virus-corona-rdg-bi-bikin-ihsg-menyerah-di-akhir-pekan?utm_source=twitter&utm_medium=oa&utm_campaign=cnbcsocmed

Bank Rakyat Indonesia Cut to Neutral at RHB Research Institute

(Bloomberg) -- RHB analyst Christopher Benas cut the recommendation on Bank Rakyat Indonesia Persero Tbk PT to neutral from buy.

PT set to IDR5,000, implies a 5.5% increase from last price. Bank Rakyat Indonesia average PT is IDR4,720.11.

Targets range from IDR3,600 to IDR5,500

Bank Rakyat Indonesia had 22 buys, 6 holds, 2 sells previously: Bloomberg data

Bank Rakyat Indonesia Cut to Hold at Ciptadana; PT IDR5,100

(Bloomberg) -- Ciptadana Sekuritas analyst Erni Siahaan cut the recommendation on Bank Rakyat Indonesia Persero Tbk PT to hold from buy.

- PT set to IDR5,100, implies a 7.8% increase from last price. Bank Rakyat Indonesia average PT is IDR4,778.42.

- Targets range from IDR3,600 to IDR5,500

- Bank Rakyat Indonesia had 24 buys, 8 holds, 2 sells previously: Bloomberg data

- Bank Rakyat Indonesia reported earnings that topped estimates for the quarter on Jan. 24.

Laba Bank Mandiri Tembus Rp 27,5 T di 2019, Naik 9,9%

https://www.cnbcindonesia.com/market/20200124084957-17-132373/laba-bank-mandiri-tembus-rp-275-t-di-2019-naik-99

Reli Berlanjut, Secara Teknikal Kemana Arah Harga Batu Bara?

https://www.cnbcindonesia.com/market/20180918191107-17-33725/reli-berlanjut-secara-teknikal-kemana-arah-harga-batu-bara

Shio apa yang paling beruntung di Tahun Tikus? Simak peruntungannya

https://lifestyle.kontan.co.id/news/shio-apa-yang-paling-beruntung-di-tahun-tikus-simak-peruntungannya

Perdagangan Lima Saham Ini Disetop Gara-Gara Kasus Jiwasraya

https://insight.kontan.co.id/news/perdagangan-lima-saham-ini-disetop-gara-gara-kasus-jiwasraya

IHSG bangkit, cek PER dan PBV saham yang melejit, Kamis (23/1)

https://investasi.kontan.co.id/news/ihsg-bangkit-cek-per-dan-pbv-saham-yang-melejit-kamis-231

Peternak ayam dan perusahaan poultry atur harga, begini kesepakatannya

https://investasi.kontan.co.id/news/peternak-ayam-dan-perusahaan-poultry-atur-harga-begini-kesepakatannya

Telkom Tertopang Penambahan Menara Baru, Begini Rekomendasi Analis untuk Saham TLKM

Kinerja Telkom (TLKM) di pusaran persaingan industri telekomunikasi yang sengit

TLKM: pasca rekomendasi pada 20 Okrober to BUY, short term weak bearish momentum dalam pola Descendjng Triangle, oversold, ada peluang rebound ke 4000-4030 intraday gap selama di atas 3800. Foreign net sell Rp 500 - Rp 2.5 triliun (1-3-6 bulan). Watch med term chart terlihat pola Three Budha Top, bad cycle hingga rawan masuk wave koreksi C ↘ Major.

Dont miss Workshop CTASaham Jakarta 1-2 Feb 2020, dapatkan discount Rp 3.5 juta, bonus & benefit lainnya.

*BANK NEGARA INDONESIA FY EPS 825 RUPIAH VS. 805 RUPIAH Y/Y

BBNI IJ Raised to Trading Buy at Mirae Asset Daewoo

(Bloomberg) -- Mirae Asset Daewoo Co.,Ltd. analyst Lee Young Jun raised the recommendation on Bank Negara Indonesia Persero Tbk PT to trading buy from hold.

PT set to IDR8,800, implies a 16% increase from last price. Bank Negara Indonesia average PT is IDR8,943.91.

Targets range from IDR7,000 to IDR10,600

Bank Negara Indonesia had 25 buys, 2 holds, 2 sells previously: Bloomberg data

Waskita Karya Rated New Overweight at JPMorgan; PT IDR2,200

(Bloomberg) -- J.P. Morgan initiated coverage of Waskita Karya Persero Tbk PT with a recommendation of overweight.

PT set to IDR2,200, implies a 65% increase from last price. Waskita Karya average PT is IDR1,848.44.

Targets range from IDR1,050 to IDR4,870

Waskita Karya had 14 buys, 11 hold, 2 sells previously: Bloomberg data

Pembangunan Perumahan Rated New Overweight at JPMorgan

(Bloomberg) -- J.P. Morgan initiated coverage of PP Persero Tbk PT with a recommendation of overweight.

PT set to IDR2,500, implies a 64% increase from last price. Pembangunan Perumahan average PT is IDR2,089.

Targets range from IDR1,560 to IDR3,986

Pembangunan Perumahan had 25 buys, 4 holds, 1 sell previously: Bloomberg data

CORRECT: Adhi Karya Rated New Hold at Maybank; PT IDR1,250

(Bloomberg) -- Maybank Kim Eng initiated coverage of Adhi Karya Persero Tbk PT with a recommendation of hold.

PT set to IDR1,250

Astra Intl. Raised to Overweight at Morgan Stanley

(Bloomberg) -- Morgan Stanley analyst Divya Gangahar Kothiyal raised the recommendation on Astra International Tbk PT to overweight from equal-weight.

Astra Intl. had 21 buy, 7 holds, 1 sell previously: Bloomberg data

Performance Metrics

Investors who followed Kothiyal's recommendation received a negative 11% return in the past year, compared with a negative 13% return on the shares.

In the last 20 months, Morgan Stanley has rated Astra Intl. overweight once and equal-weight twice.

The stock fell an average 7.9% in the periods rated overweight and rose 3% in the periods rated equal-weight.

Astra Agro Raised to Outperform at Macquarie; PT IDR15,500

(Bloomberg) -- Macquarie analyst Richard Danusaputra raised the recommendation on Astra Agro Lestari Tbk PT to outperform from neutral.

PT set to IDR15,500, implies a 24% increase from last price. Astra Agro average PT is IDR14,687.

Targets range from IDR9,675 to IDR17,930

Astra Agro had 15 buys, 5 holds, 0 sells previously: Bloomberg data

Surya Citra Rated New Buy at Indo Premier Securities

(Bloomberg) -- Indo Premier Securities initiated coverage of Surya Citra Media Tbk PT with a recommendation of buy.

PT set to IDR2,000, implies a 25% increase from last price. Surya Citra average PT is IDR1,760.

Targets range from IDR1,510 to IDR3,550

Surya Citra had 17 buys, 0 holds, 0 sells previously: Bloomberg data

Japfa Comfeed Falls Most in Five Months on Low Broiler Prices

(Bloomberg) -- Shares of Japfa Comfeed drop as much as 5.7%, the most since Aug. 6, as Kresna Sekuritas says the government’s recent culling program has not been able to prop up broiler prices.

Prices have remained low due to overpopulation of broiler chickens, analyst Timothy Gracianov says in phone interview

NOTE: Govt ordered cull in June 2019 to boost prices and disposed of 10m chicken eggs; prices have hovered at 15,000 rupiah per kilogram since early Jan., Kontan newspaper reported Tuesday

Krena sees breakeven price at 17,500-18,000 rupiah per kg

Japfa’s business prospects remain positive this year as long as govt continues with culling program, on larger scale, Gracianov says

Kresna forecasts company’s revenue and net income to rise to 41t rupiah and 1.92t rupiah in 2020 vs market consensus of 36.5t rupiah and 1.5t rupiah for 2019

Soft Coal Prices to Help Indonesian Cement Makers’ Income: Mirae

(Bloomberg) -- Coal prices are expected to remain soft this year, supporting cement companies’ profitability amid limited average selling price growth outlook, according to Mirae Asset Sekuritas.

ASP growth outlook seen limited due to moderate growth demand outlook for 2020, analyst Mimi Halimin writes in report dated Jan. 20

Mirae estimates domestic cement consumption to grow 4.5% y/y this year on dissipating election-related uncertainties and low-base effects

Semen Indonesia is top pick

Mirae maintains neutral recommendation on cement sector

NOTE: Indonesia’s 2019 Domestic Cement Sales +0.34% Y/y to 69.78M Tons

Indonesia

Global funds sold a net $38.1 million in Indonesian bonds on Jan. 17, according to finance ministry data

Bought a net $16.3 million in country's equities on Jan. 21, according to exchange data

PALM OIL: Futures Drop for 2nd Day on Weaker Petroleum, Soyoil

(Bloomberg) -- Palm oil slipped for a second day, tracking an overnight slump in rival soybean oil, caused by a lack of Chinese demand for soybeans, and a further drop in petroleum which dampened the tropical oil’s appeal as a biofuel.

Citigroup Bullish on EM Asia FX Via Options, Sees More Rate Cuts

(Bloomberg) -- Citigroup is bullish on emerging Asian currencies and recommends trading via options because the broad dollar index hasn’t been weakening in the spot market, analysts led by Johanna Chua in Hong Kong and Gaurav Garg in Singapore write in a Jan. 21 note.

Co. sees cautious and leveraged investors limiting the risk of a sharp gain in the dollar versus Asian FX, unless broad risk sentiment deteriorates

Co. expects INR and IDR to strengthen further

WIKA dapat kas masuk Rp 10 triliun

Incar Dana IPO Rp 2 Triliun

https://t.co/x5VtOTEPAa

https://t.co/x5VtOTEPAa

WIKA: technical intraday menunjukkan pola Inverted H&S, oversold, weak momentum, finishing wave koreksi C ↘, untuk buy on weakness (follow buy sell signal & tanda panah atas bawah). Foreign sell di saham WIKA dalam 1 minggu (Rp 31 miliar) & 1 bulan (Rp 77 miliar).

IHSG konsolidasi, dalam pola double top minor dalam triangle major, prefer sektor finance consumer trade; property infra mining oversold. Watch BI Rate, earnings & Wal Street.

Week Ahead: Overbought Stocks Likely To Move Higher

https://lnkd.in/fkW8AMe

IHSG diperkirakan cenderung melemah di minggu depan, ini alasannya

https://lnkd.in/fhjDqY2

Pekan Ini Pasar Sibuk, Pekan Depan Boleh Santai?

https://lnkd.in/f-Ripps

REKOMENDASI SAHAM: Waspadai Sektor Pembiayaan dan Komoditas

https://lnkd.in/fnu_Sux

Simak prospek saham perbankan untuk tahun 2020

https://lnkd.in/f768hr9

Samuel Sekuritas: Senin (20/1), Pantau Saham BBRI, BBCA, ADRO, UNTR

https://market.bisnis.com/read/20200118/189/1191536/samuel-sekuritas-senin-201-pantau-saham-bbri-bbca-adro-untr

https://market.bisnis.com/read/20200118/189/1191536/samuel-sekuritas-senin-201-pantau-saham-bbri-bbca-adro-untr

Reliance Sekuritas: Awal Pekan Depan IHSG Menguat, Perhatikan 11 Saham

https://market.bisnis.com/read/20200118/189/1191532/reliance-sekuritas-awal-pekan-depan-ihsg-menguat-perhatikan-11-saham

https://market.bisnis.com/read/20200118/189/1191532/reliance-sekuritas-awal-pekan-depan-ihsg-menguat-perhatikan-11-saham

Investor Khawatir AS-Eropa, Waspada IHSG Melemah Besok!

https://www.cnbcindonesia.com/market/20200119115344-17-131054/investor-khawatir-as-eropa-waspada-ihsg-melemah-besok?fbclid=IwAR1YmXRJOimCXsTAA6THnG1seO5cUBZfSnSBCvZFxKufGsBeDY_8H95hC0Q

https://www.cnbcindonesia.com/market/20200119115344-17-131054/investor-khawatir-as-eropa-waspada-ihsg-melemah-besok?fbclid=IwAR1YmXRJOimCXsTAA6THnG1seO5cUBZfSnSBCvZFxKufGsBeDY_8H95hC0Q

REKOMENDASI SAHAM: Waspadai Sektor Pembiayaan dan Komoditas

https://market.bisnis.com/read/20200118/7/1191508/rekomendasi-saham-waspadai-sektor-pembiayaan-dan-komoditas

https://market.bisnis.com/read/20200118/7/1191508/rekomendasi-saham-waspadai-sektor-pembiayaan-dan-komoditas

AS-China capai kesepakatan dagang tahap I, ini saham komoditas rekomendasi analis

https://investasi.kontan.co.id/news/as-china-capai-kesepakatan-dagang-tahap-i-ini-saham-komoditas-rekomendasi-analis?fbclid=IwAR3wDyAvAPYQknIt7PbIMrScum2Y3ND7H7IsdM0b1-TlIyssq9t_9eV-FUQ

https://investasi.kontan.co.id/news/as-china-capai-kesepakatan-dagang-tahap-i-ini-saham-komoditas-rekomendasi-analis?fbclid=IwAR3wDyAvAPYQknIt7PbIMrScum2Y3ND7H7IsdM0b1-TlIyssq9t_9eV-FUQ

Simak prospek saham perbankan untuk tahun 2020

https://investasi.kontan.co.id/news/simak-prospek-saham-perbankan-untuk-tahun-2020?fbclid=IwAR37bCpGyFtejrMJJ67lSzonxIq-ZLbqSfqe7876C79jTLHYzSwZmpsjhv4

https://investasi.kontan.co.id/news/simak-prospek-saham-perbankan-untuk-tahun-2020?fbclid=IwAR37bCpGyFtejrMJJ67lSzonxIq-ZLbqSfqe7876C79jTLHYzSwZmpsjhv4

Weleh-weleh, Harga Batu Bara Anjlok Hampir 6%!

https://www.cnbcindonesia.com/market/20200119082253-17-131031/weleh-weleh-harga-batu-bara-anjlok-hampir-6?fbclid=IwAR2yspNfi0Wjfr7fapi34gCc9XV42fD2mY2t69_wU3madpiIhkFFLDVEfOI

https://www.cnbcindonesia.com/market/20200119082253-17-131031/weleh-weleh-harga-batu-bara-anjlok-hampir-6?fbclid=IwAR2yspNfi0Wjfr7fapi34gCc9XV42fD2mY2t69_wU3madpiIhkFFLDVEfOI

Saham emiten CPO berpotensi bullish, berikut perusahaan yang layak dikoleksi

https://www.cnbcindonesia.com/market/20200119082253-17-131031/weleh-weleh-harga-batu-bara-anjlok-hampir-6?fbclid=IwAR2yspNfi0Wjfr7fapi34gCc9XV42fD2mY2t69_wU3madpiIhkFFLDVEfOI

https://www.cnbcindonesia.com/market/20200119082253-17-131031/weleh-weleh-harga-batu-bara-anjlok-hampir-6?fbclid=IwAR2yspNfi0Wjfr7fapi34gCc9XV42fD2mY2t69_wU3madpiIhkFFLDVEfOI

STOCK PICK 2020

PICK THE LEADING

BUY ON WEAKNESS THE LAGGARS

Kinerja Saham Pilihan yang memiliki return kenaikan terbaik (%) & likuiditas tinggi dari 676 saham di Bursa Efek indonesia, untuk Buy the Leading (disesuaikan time frame dengan kebutuhan, better check juga dengan Fundamental & Technical Chartnya). Good luck & semoga happy cuan.

(Bloomberg) -- OCBC Sekuritas lowered the rating on shares of the Indonesian state construction firm from buy because it expects flat new contract growth in 2020.

- PP may book only 7.5% Y/y growth this year after unsatisfactory progress in 2019, analyst Liga Maradona writes in report dated Jan. 16

- PP may fail to achieve its new-contract target for 2019 as realization remained weak through Nov., with only 60.4%

- OCBC expects 2019 new contracts to fall by 12.5% Y/y

- OCBC also notes a surge in interest expense and margin contraction from gross, operating and net income

- Expects PP revenue to rise 5.5% Y/y in 2019, but net income to fall 23.6%

- Profit margin seen dropping due to revenue decline in high-margin segments such as EPC and property, as well as surge in interest expense

- Revenue and net income to slightly improve in 2020 with Indonesia’s infrastructure works

- OCBC cuts PT to 1,560 rupiah from 4,600 rupiah

- Stock has 24 buys, 3 holds, 1 sell; average PT ~2,102 rupiah: Bloomberg data

Surya Citra Rises to 5-Month High on Improved Audience Share

(Bloomberg) -- Shares rise as much as 5.2% to highest since Aug. 1 as a RHB Sekuritas report spurred optimism the Indonesian media company will continue to control significant audience share.

The power of technical analysis part 3. Strategi saham Indonesia Desember 2019 & saham BBCA.- Surya Citra’s return to top position on prime time TV segment in December bodes well for investors, says analyst Ghibran Al Imran, citing data from Nielsen

- Surya Citra ranked No. 1 on prime time TV segment in December, overtaking Media Nusantara, which sat on top spot since July

- Surya Citra ranked No. 2 after Media Nusantara for overall 2019

- Recent collaboration deal with Media Nusantara expected to lead to healthier ad rate competition

- Investors now waiting for details of the collaboration and Surya Citra’s guidance on ad rates for 2020

- A 1% increase in ad rates may increase EPS by 2.7% for Surya Citra

- NOTE: Media Nusantara, Surya Citra Sign Content Collaboration Deal (1)

- RHB maintains buy on Surya Citra

Bank Negara Indonesia Cut to Sell at Citi; PT IDR7,000

(Bloomberg) -- Citi cut the recommendation on Bank Negara Indonesia Persero Tbk PT to sell from neutral.

- PT set to IDR7,000, implies a 9.7% decrease from last price. Bank Negara Indonesia average PT is IDR9,054.40.

- Targets range from IDR7,500 to IDR10,600

- Bank Negara Indonesia had 24 buys, 4 holds, 1 sell previously: Bloomberg data

Indonesia Posts Smaller Trade Deficit as Exports Rebound: Bureau

(Bloomberg) -- Trade deficit in December totals $30m, compared with median estimate for $422m in a Bloomberg survey.

IHSG Nyaman di Zona Hijau, Saham-saham Ini Melonjak 5%-34%

https://investor.id/market-and-corporate/ihsg-nyaman-di-zona-hijau-sahamsaham-ini-melonjak-534- Exports rose 1.28% to $14.47b last month, while imports fell 5.62% to $14.5b, according to Indonesia’s statistics bureau

- Exports in 2019 fell 6.94% to $167.5 billion and full-year imports dived 9.53% to $170.72 billion

- 2019 trade deficit stood at $3.2 billion, data released by the bureau in Jakarta showed

Adaro Energy Raised to Neutral at JPMorgan; PT IDR1,500

(Bloomberg) -- J.P. Morgan analyst Sumedh Samant raised the recommendation on Adaro Energy Tbk PT to neutral from underweight.

- PT set to IDR1,500, implies a 3.8% decrease from last price. Adaro Energy average PT is IDR1,530.80.

- Targets range from IDR812 to IDR2,410

- Adaro Energy had 14 buys, 9 holds, 3 sells previously: Bloomberg data

Bukit Asam Raised to Overweight at JPMorgan; PT IDR3,500

(Bloomberg) -- J.P. Morgan analyst Sumedh Samant raised the recommendation on Bukit Asam Tbk PT to overweight from neutral.

- PT set to IDR3,500, implies a 25% increase from last price. Bukit Asam average PT is IDR2,706.44.

- Targets range from IDR1,820 to IDR4,880

- Bukit Asam had 11 buy, 10 holds, 4 sells previously: Bloomberg data

Indo Tambangraya Raised to Overweight at JPMorgan; PT IDR16,000

(Bloomberg) -- J.P. Morgan analyst Sumedh Samant raised the recommendation on Indo Tambangraya Megah Tbk PT to overweight from neutral.

- PT set to IDR16,000, implies a 20% increase from last price. Indo Tambangraya average PT is IDR13,497.69.

- Targets range from IDR9,700 to IDR35,700

- Indo Tambangraya had 8 buys, 7 holds, 5 sells previously: Bloomberg data

Gudang Garam Reinstated Neutral at Goldman; PT IDR53,025

(Bloomberg) -- Goldman Sachs reinstated coverage of Gudang Garam Tbk PT with a recommendation of neutral.

- PT set to IDR53,025, implies a 9.1% decrease from last price. Gudang Garam average PT is IDR59,064.66.

- Targets range from IDR47,700 to IDR99,000

- Gudang Garam had 21 buy, 9 holds, 3 sells previously: Bloomberg data

Indofood Sukses Reinstated Buy at Goldman; PT IDR9,200

(Bloomberg) -- Goldman Sachs reinstated coverage of Indofood Sukses Makmur Tbk PT with a recommendation of buy.

- PT set to IDR9,200, implies a 13% increase from last price. Indofood Sukses average PT is IDR9,242.38.

- Targets range from IDR7,300 to IDR10,500

- Indofood Sukses had 25 buys, 2 holds, 0 sells previously: Bloomberg data

Unilever Indonesia Reinstated Buy at Goldman; PT IDR9,725

(Bloomberg) -- Goldman Sachs reinstated coverage of Unilever Indonesia Tbk PT with a recommendation of buy.

- PT set to IDR9,725, implies a 15% increase from last price. Unilever Indonesia average PT is IDR8,837.49.

- Targets range from IDR2,029.20 to IDR10,508

- Unilever Indonesia had 7 buys, 20 holds, 5 sells previously: Bloomberg data

HM Sampoerna Reinstated Sell at Goldman; PT IDR1,670

(Bloomberg) -- Goldman Sachs reinstated coverage of Hanjaya Mandala Sampoerna Tbk PT with a recommendation of sell.

- PT set to IDR1,670, implies a 28% decrease from last price. HM Sampoerna average PT is IDR2,266.90.

- Targets range from IDR1,450 to IDR4,000

- HM Sampoerna had 15 buys, 10 holds, 7 sells previously: Bloomberg data

Indofood CBP Reinstated Neutral at Goldman; PT IDR11,725

(Bloomberg) -- Goldman Sachs reinstated coverage of Indofood CBP Sukses Makmur Tbk PT with a recommendation of neutral.

- PT set to IDR11,725, implies a 1.1% increase from last price. Indofood CBP average PT is IDR12,581.48.

- Targets range from IDR9,300 to IDR13,800

- Indofood CBP had 20 buys, 9 holds, 2 sells previously: Bloomberg data

Kalbe Farma Reinstated Neutral at Goldman; PT IDR1,545

(Bloomberg) -- Goldman Sachs reinstated coverage of Kalbe Farma Tbk PT with a recommendation of neutral.

- PT set to IDR1,545, implies a 2.5% decrease from last price. Kalbe Farma average PT is IDR1,710.50.

- Targets range from IDR1,200 to IDR2,000

- Kalbe Farma had 15 buys, 8 holds, 4 sells previously: Bloomberg data

Matahari Department Store Reinstated Sell at Goldman

(Bloomberg) -- Goldman Sachs reinstated coverage of Matahari Department Store Tbk PT with a recommendation of sell.

- PT set to IDR3,100, implies a 28% decrease from last price. Matahari Department Store average PT is IDR3,831.

- Targets range from IDR3,100 to IDR11,700

- Matahari Department Store had 6 buys, 12 holds, 5 sells previously: Bloomberg data

Asing Agresif Akumulasi, Saham BRI Tembus Rekor Baru

https://www.cnbcindonesia.com/market/20200114124229-17-129844/asing-agresif-akumulasi-saham-bri-tembus-rekor-baru?utm_source=twitter&utm_medium=oa&utm_campaign=cnbcsocmed

Banyak Saham Lapis Dua Berfundamental Bagus https://investor.id/market-and-corporate/banyak-saham-lapis-dua-berfundamental-bagus Saham Lapis Kedua https://investor.id/editorial/saham-lapis-kedua Kinerja Harga Sepuluh Saham Investasi Jiwasraya dan Asabari https://www.kompasiana.com/yahowu/5e1d468fd541df525432bfe2/kinerja-harga-sepuluh-saham-investasi-jiwasraya-dan-asabari Kapitalisasi Pasar Saham Terbesar 2020 https://pusatis.com/investasi-saham/daftar-saham/kapitalisasi-pasar-saham-terbesar/

Ace Hardware Raised to Outperform at Credit Suisse; PT IDR1,725 (Bloomberg) -- Credit Suisse analyst Deidy Wijaya raised the recommendation on Ace Hardware Indonesia Tbk PT to outperform from neutral. PT set to IDR1,725, implies a 16% increase from last price. Ace Hardware average PT is IDR1,670.59. Targets range from IDR1,220 to IDR1,900 Ace Hardware had 5 buys, 14 holds, 5 sells previously: Bloomberg data Semen Indonesia Reinstated Overweight at Morgan Stanley (Bloomberg) -- Morgan Stanley reinstated coverage of Semen Indonesia Persero Tbk PT with a recommendation of overweight. PT set to IDR14,500, implies a 19% increase from last price. Semen Indonesia average PT is IDR14,885.71. Targets range from IDR8,050 to IDR18,500 Semen Indonesia had 25 buys, 5 holds, 3 sells previously: Bloomberg data Indocement Reinstated Overweight at Morgan Stanley (Bloomberg) -- Morgan Stanley reinstated coverage of Indocement Tunggal Prakarsa Tbk PT with a recommendation of overweight. PT set to IDR20,500, implies a 12% increase from last price. Indocement average PT is IDR20,593.13. Targets range from IDR13,000 to IDR25,700 Indocement had 9 buys, 15 holds, 8 sells previously: Bloomberg data Time to Shift to Value Strategies in Asia, CLSA Says (Bloomberg) -- Value strategies will outperform in Asia this year, according to a CLSA note that cited positive indicators from its style-factor rotation framework. Overweight China, Korea, Indonesia, real estate, energy and telecommunications Underweight Australia, New Zealand, Hong Kong, health care, utilities and consumer staples Morgan Stanley Flags Risk of Nickel Prices Sinking Below $13,000 (Bloomberg) -- Weaker nickel prices will persist through 1H, with a risk of drop below $13,000/ton driven by rising exchange inventories, falling demand, according to Morgan Stanley. ASIA COAL: China Futures Hold Drop as Users Seen Halting Output (Bloomberg) -- Thermal coal for May delivery little changed at 554.4 yuan/ton on Zhengzhou Commodity Exchange as of 9:43am local time. Futures -0.6% on Monday Price gains will be limited in the near term due to production suspension at downstream industries, such as cement and steel, ahead of Lunar New Year and abundant coal inventory at power plants, Daiwa Capital Markets analysts including Dennis Ip said in a note Global Funds Buy Indonesian Bonds, Sell Indian Indonesia Global funds bought a net $553.1 million in Indonesian bonds on Jan. 9, according to finance ministry data Bought a net $18.3 million in country's equities on Jan. 13, according to exchange data

The Power of Technical Analysis. If you do it right you can be A Success Trader. 12 saham pilihan by technical analysis 2019 (average return: +34.35%/ saham), jauh lebih tinggi dari IHSG (YTD 2019 +1.70%). Semoga saham pilihan 2020 kembali happy super cuan ✈🎯🙏

Produksi domestik dibatasi, simak rekomendasi saham emiten tambang batubara

Damai, Kesepakatan Dagang AS & China Fase 1 Segera Diteken

AS-Iran Masih Panas, Ini Risiko Bagi IHSG

2020, Laba Emiten Diprediksi Tumbuh 9%, IHSG Berpotensi Capai Level 7.000

Read more at: https://investor.id/market-and-corporate/2020-laba-emiten-diprediksi-tumbuh-9-ihsg-berpotensi-capai-level-7000

Read more at: https://investor.id/market-and-corporate/2020-laba-emiten-diprediksi-tumbuh-9-ihsg-berpotensi-capai-level-7000

News for Asia trading Monday 13 January 2020

Chart IHSG USDIDR & 4 SEKTOR leading di Indonesia. Sesuai ekspektasi CTASaham komoditas & sahamnya (3 Jan), rally di saham energi & metal, saham batubara menyusul di akhir pekan. Pekan ini pasar akan dibanjiri sentimen dari dalam & luar negeri.

Indonesian Coal Stocks Rise on Government’s Lower Output Target

(Bloomberg) -- Coal companies may benefit from government’s plan to cut production this year, according to analysts.

- The plan, if executed properly, should be good to control supply given muted demand growth, Richard Suherman, analyst at Sinarmas Sekuritas, says by text message Friday

- Sinarmas remains cautious, especially on policy enforcement, as output had been higher than target in previous years

- Production cut will reduce global supply and lead to improvement in selling prices, says Yanuar Hardy, analyst at Kresna Sekuritas

- NOTE: Govt sets 2020 production target at 550m metric tons, 9.8% lower than realized output last year

- Coal companies lead increase among 45 most liquid stocks on Friday

- Indo Tambangraya Megah +4.6%; Indika Energy +2.8% and Adaro Energy +2.7%

- INDONESIA: Indonesia’s rupiah advances to the strongest since April 2018 after the central bank said it would allow the currency to strengthen with regional peers due to the country’s sound economic outlook. Sovereign bonds also rise.

- Indonesia Signals Currency Intervention Unlikely; Rupiah Jumps

- Geopolitical Risks Pose No Significant Threat to Rupiah: C. Bank

- Indonesia Invites Japan to Invest in Natuna Islands: Jokowi (1)

Analis prediksi IHSG bisa tembus 6.800 hingga akhir tahun 2020

https://investasi.kontan.co.id/news/analis-prediksi-ihsg-bisa-tembus-6800-hingga-akhir-tahun-2020

Apa Saja Saham Favorit Samuel Sekuritas pada 2020?

https://market.bisnis.com/read/20200110/189/1188824/apa-saja-saham-favorit-samuel-sekuritas-pada-2020

Ini Alasan Panin AM Targetkan IHSG Tembus 7.500 Tahun Ini

https://market.bisnis.com/read/20200110/7/1188821/ini-alasan-panin-am-targetkan-ihsg-tembus-7.500-tahun-ini

Awas! Dolar AS Diprediksi Menguat Tajam di Tahun Ini

https://www.cnbcindonesia.com/market/20200109210138-17-129015/awas-dolar-as-diprediksi-menguat-tajam-di-tahun-ini

Perang AS-Iran mereda, tengok PBV 20 saham LQ45 dengan PER terendah ini

https://investasi.kontan.co.id/news/perang-as-iran-mereda-tengok-pbv-20-saham-lq45-dengan-per-terendah-ini

Amati valuasi saham yang paling jeblok saat IHSG rebound, Kamis (9/1)

https://investasi.kontan.co.id/news/amati-valuasi-saham-yang-paling-jeblok-saat-ihsg-rebound-kamis-91

Harga saham emiten rokok kembali naik, ini penyebabnya menurut analis

https://investasi.kontan.co.id/news/harga-saham-emiten-rokok-kembali-naik-ini-penyebabnya-menurut-analis

Bisnis hingga Investasi Apa yang Cuan di Tahun Tikus Logam?

CHART GOLD & CRUDE OIL (INIDIKATOR UNTUK SAHAM METAL COAL & OIL)

Chart Crude Oil & Gold (8 Januari), yang berhubungan dengan analisa saham untuk saham komoditas metal (ANTM MDKA PSAB dll), Energi (ELSA ESSA MEDC PTRO dll), tidak secara langsung ke batu bara (ADRO BUMI ITMG PTBA dll).

-------------------

Trend crude masih bullish selama diatas $ 58, masih ada peluang menuju $ 66-$74 (target akhir tahun 2020) bahkan $84 (GOOD NEWS untuk saham energi & minyak) jika situasi di Timur Tengah kian memburuk. Closed below $57 berpeluang menuju range $50-$ 55 (bad news untuk saham minyak di IHSG.

--------------------

Trend gold masih bullish selama diatas 1.556 (ex high 2019), berpeluang menuju target $ 1.590 (tercapai)-$ 1.640-$ 1.680 (good news utk saham emas di IHSG. Jika closed di bawah $ 1.550, gold akan kembali konsolidasi untuk wave koreksi minor setelah capai high $1.611 (bida picu profit taking di saham emas.

--------------------

CTASaham & CTAFX Gold tidak melihat efek berkelanjutan menuju big war di Timur Tengah di kuartal 1-2 2020. Watch data Non Farm Payroll AS besok rilis, untuk melihat trend gold & oil di pekan mendatang.

Trend crude masih bullish selama diatas $ 58, masih ada peluang menuju $ 66-$74 (target akhir tahun 2020) bahkan $84 (GOOD NEWS untuk saham energi & minyak) jika situasi di Timur Tengah kian memburuk. Closed below $57 berpeluang menuju range $50-$ 55 (bad news untuk saham minyak di IHSG.

--------------------

Trend gold masih bullish selama diatas 1.556 (ex high 2019), berpeluang menuju target $ 1.590 (tercapai)-$ 1.640-$ 1.680 (good news utk saham emas di IHSG. Jika closed di bawah $ 1.550, gold akan kembali konsolidasi untuk wave koreksi minor setelah capai high $1.611 (bida picu profit taking di saham emas.

--------------------

CTASaham & CTAFX Gold tidak melihat efek berkelanjutan menuju big war di Timur Tengah di kuartal 1-2 2020. Watch data Non Farm Payroll AS besok rilis, untuk melihat trend gold & oil di pekan mendatang.

Morgan Stanley Sees Indonesia Bank Earnings Accelerating in 2020

(Bloomberg) -- Indonesia bank earnings will grow by 16% this year compared to 4% in 2019 in the wake of conducive business environment after the formation of the new government and easing liquidity, Morgan Stanley analysts including Mulya Chandra write in note.

- Loan growth would accelerate to 11.7% from 8.9%

- Top picks include Bank Rakyat, Bank Central

- Upgrades Bank Danamon to equal-weight from underweight

Palm Oil Price to Boost Indonesia’s Domestic Spending: Mirae

(Bloomberg) -- Rally in palm oil price since October should drive up domestic consumption and support corporate earnings growth this year, according to Hariyanto Wijaya and Emma Fauni, analysts at Mirae Asset Sekuritas Indonesia.

- Recovery in Indonesia’s PMI in December should also boost market sentiment for 2020: Mirae

- Bank Central Asia, Unilever, Indofood Sukses Makmur, Japfa Comfeed, Mitra Adiperkasa, Indo Tambangraya Megah, Aneka Tambang and Wijaya Karya are top picks at Mirae Asset

- NOTE: PALM OIL: Futures Resume Advance on Bullish Fundamentals

Indonesia’s Foreign Reserves Rise to Near 2-Year High

(Bloomberg) -- Foreign reserves jumped to $129.2b in December from $126.6b a month earlier, Bank Indonesia says in statement on website.

- Reserves equivalent to 7.6 months of imports or 7.3 months of imports and repayment of govt’s offshore borrowings

- Bank Indonesia sees the reserves at sufficient level, supported by stability and sound economic outlook

- NOTE: Reserves highest since a record of $131.98b reached in Jan. 2018

Tiga Wadah Investasi Paling Berprospek Tahun Ini

https://katadata.co.id/berita/2020/01/08/tiga-wadah-investasi-paling-berprospek-tahun-ini2020, Analis Nilai Pasar Saham Berpotensi “Cuan” Minimal 10% https://investor.id/market-and-corporate/2020-analis-nilai-pasar-saham-berpotensi-cuan-minimal-10 IHSG ambyar, dihantui isu AS - Iran

https://www.cnbcindonesia.com/market/20200106083623-17-127826/dihantui-perang-as-iran-ihsg-bakal-ambyar

Cuan di awal pekan ini dari deretan analisa pilihan broker https://www.cnbcindonesia.com/market/20200106082653-17-127823/cuan-di-awal-pekan-ini-deretan-saham-pilihan-broker

Kalender Ekonomi - 5 Hal Penting Diketahui pada Minggu Ini

https://id.investing.com/news/economy/kalender-ekonomi--5-hal-penting-diketahui-pada-minggu-ini-1946957

Week Ahead: Investors May Take Profit On Mid-East Tensions; Gold Could Soar

https://www.investing.com/analysis/week-ahead-investors-may-take-profit-on-mideast-tensions-gold-could-soar-200496434

Inilah Yang Dapat Menggagalkan Reli Pasar di Tahun 2020

https://id.investing.com/analysis/inilah-yang-dapat-menggagalkan-reli-pasar-di-tahun-2020-200216086

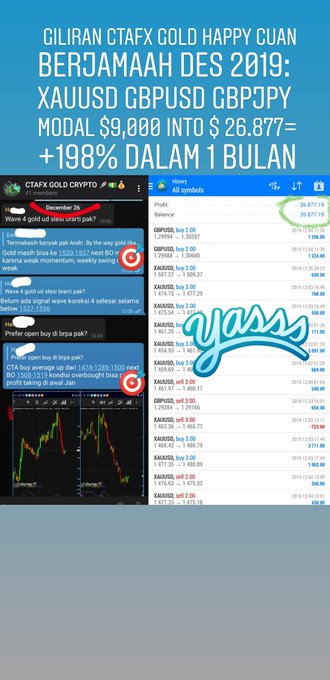

Strategi 11 saham pilihan dll CTASaham saat windress & santa rally 2019, terbukti happy cuan berjamaah. Strategi CTASaham & CTAFX Gold, kombinasi untuk happy cuan di saat harga komoditas di bulan Desember 2019.

Well done untuk technical analysis IHSG in 2019, Target 6.250 (dibuat 11 Juli 2019, upgrade dari 6.150 chart Des 2018) missed hanya -0.67% dari closing 30 Des 2019 di 6.299 (+1.70%).