Volatile January As Expected As No January Effect! Astrocycle Signs Should Be Good For Bottom Fishing In February

https://investasi.kontan.co.id/news/ihsg-merosot-di-hari-keenam-ditutup-ke-542070-jelang-akhir-pekan

Kapitalisasi bursa hangus hampir Rp 500 triliun dalam sepekan

https://investasi.kontan.co.id/news/kapitalisasi-bursa-hangus-hampir-rp-500-triliun-dalam-sepekan

Virus corona tambah parah, rupiah melemah 4,05% sepekan ini

https://investasi.kontan.co.id/news/virus-corona-tambah-parah-rupiah-melemah-405-sepekan-ini

Black Friday! 4 Saham Ini Jadi Penolong IHSG Tipiskan Koreksi

https://www.cnbcindonesia.com/market/20200228162931-17-141259/black-friday-4-saham-ini-jadi-penolong-ihsg-tipiskan-koreksi

'Obat' Virus Corona Dijual Tokopedia Cs, Harganya Rp 95.000

https://www.cnbcindonesia.com/tech/20200228163446-37-141261/obat-virus-corona-dijual-tokopedia-cs-harganya-rp-95000

Koreksi IHSG Dinilai Lebay, Investor Disarankan Cicil Beli

https://www.cnbcindonesia.com/market/20200228163921-17-141263/koreksi-ihsg-dinilai-lebay-investor-disarankan-cicil-beli

PP London Sumatra Raised to Buy at DBS Bank; PT IDR1,180

(Bloomberg) -- DBS Bank analyst William Simadiputra raised the recommendation on Perusahaan Perkebunan London Sumatra Indonesia Tbk PT to buy from hold.

PT set to IDR1,180, implies a 22% increase from last price. PP London Sumatra average PT is IDR1,627.50.

Targets range from IDR1,100 to IDR1,800

PP London Sumatra had 14 buys, 3 holds, 0 sells previously: Bloomberg data

Astra Intl. Raised to Buy at RHB Research Institute

(Bloomberg) -- RHB analyst Andrey Wijaya raised the recommendation on Astra International Tbk PT to buy from neutral.

PT set to IDR6,700, implies a 21% increase from last price. Astra Intl. average PT is IDR7,735.18.

Targets range from IDR6,300 to IDR9,000

Astra Intl. had 24 buys, 4 holds, 1 sell previously: Bloomberg data

Astra Intl. reported earnings that topped and sales that trailed estimates for the quarter on Feb. 27.

ITMG IJ Rated New Hold at PT NH Korindo Securities Indonesia

(Bloomberg) -- PT NH Korindo Securities Indonesia initiated coverage of Indo Tambangraya Megah Tbk PT with a recommendation of hold.

PT set to IDR12,000, implies a 6.2% increase from last price. Indo Tambangraya average PT is IDR13,007.33.

Targets range from IDR9,600 to IDR35,700

Indo Tambangraya had 8 buys, 9 holds, 3 sells previously: Bloomberg data

Indo Tambangraya reported earnings that trailed estimates for the quarter on Feb. 21.

United Tractors Raised to Buy at Maybank; PT IDR20,000

(Bloomberg) -- Maybank Kim Eng analyst Isnaputra Iskandar raised the recommendation on United Tractors Tbk PT to buy from sell.

PT set to IDR20,000, implies a 20% increase from last price. United Tractors average PT is IDR24,230.

Targets range from IDR19,000 to IDR35,000

United Tractors had 20 buys, 8 holds, 3 sells previously: Bloomberg data

United Tractors reported earnings that topped and sales that trailed estimates for the quarter on Feb. 27.

Bukit Asam Raised to Buy at PT NH Korindo Securities Indonesia

(Bloomberg) -- PT NH Korindo Securities Indonesia analyst Meilki Darmawan raised the recommendation on Bukit Asam Tbk PT to buy from hold.

PT set to IDR2,800, implies a 25% increase from last price. Bukit Asam average PT is IDR2,819.09.

Targets range from IDR1,820 to IDR4,880

Bukit Asam had 13 buys, 8 holds, 4 sells previously: Bloomberg data

Matahari Department Store Cut to Hold at CIMB; PT IDR3,300

(Bloomberg) -- CIMB analyst Patricia Gabriela cut the recommendation on Matahari Department Store Tbk PT to hold from add.

PT set to IDR3,300, implies a 7.1% increase from last price. Matahari Department Store average PT is IDR3,689.29.

Targets range from IDR2,800 to IDR11,700

Matahari Department Store had 5 buys, 12 holds, 6 sells previously: Bloomberg data

Matahari Department Store reported earnings and sales that trailed estimates for the quarter on Feb. 27.

Kalbe Farma Cut to Hold at CIMB; PT IDR1,350

(Bloomberg) -- CIMB analyst Patricia Gabriela cut the recommendation on Kalbe Farma Tbk PT to hold from add.

PT set to IDR1,350, implies a 8% increase from last price. Kalbe Farma average PT is IDR1,625.

Targets range from IDR1,200 to IDR2,000

Kalbe Farma had 15 buys, 8 holds, 3 sells previously: Bloomberg data

Industri Jamu Reinstated Buy at Kresna Graha Sekurindo

(Bloomberg) -- Kresna Securities reinstated coverage of Industri Jamu Dan Farmasi Sido Muncul Tbk PT with a recommendation of buy.

PT set to IDR1,460, implies a 18% increase from last price. Industri Jamu average PT is IDR1,422.92.

Targets range from IDR1,050 to IDR1,500

Industri Jamu had 10 buys, 4 holds, 0 sells previously: Bloomberg data

Surya Semesta Internusa Reinstated Buy at Sucor Sekuritas

(Bloomberg) -- Sucor Sekuritas reinstated coverage of Surya Semesta Internusa Tbk PT with a recommendation of buy.

PT set to IDR900, implies a 50% increase from last price. Surya Semesta Internusa average PT is IDR1,015.71.

Targets range from IDR650 to IDR1,400

Surya Semesta Internusa had 12 buys, 2 holds, 0 sells previously: Bloomberg data

Bank Rakyat Indonesia Cut to Neutral at JPMorgan; PT IDR4,600

(Bloomberg) -- J.P. Morgan analyst Harsh Wardhan Modi cut the recommendation on Bank Rakyat Indonesia Persero Tbk PT to neutral from overweight.

Bank Danamon Raised to Buy at Maybank; PT IDR5,000- PT set to IDR4,600, implies a 2.2% increase from last price. Bank Rakyat Indonesia average PT is IDR4,779.54.

- Targets range from IDR3,400 to IDR5,500

- Bank Rakyat Indonesia had 21 buy, 9 holds, 3 sells previously: Bloomberg data

Bank Mandiri Cut to Neutral at JPMorgan; PT IDR8,000

(Bloomberg) -- J.P. Morgan analyst Harsh Wardhan Modi cut the recommendation on Bank Mandiri Persero Tbk PT to neutral from overweight.

- PT set to IDR8,000, implies a 2.6% increase from last price. Bank Mandiri average PT is IDR8,755.92.

- Targets range from IDR7,500 to IDR10,100

- Bank Mandiri had 27 buys, 5 holds, 0 sells previously: Bloomberg data

Bank Negara Indonesia Cut to Neutral at JPMorgan; PT IDR7,700

(Bloomberg) -- J.P. Morgan analyst Harsh Wardhan Modi cut the recommendation on Bank Negara Indonesia Persero Tbk PT to neutral from overweight.

- PT set to IDR7,700, implies a 2.7% increase from last price. Bank Negara Indonesia average PT is IDR8,914.96.

- Targets range from IDR7,000 to IDR10,525

- Bank Negara Indonesia had 24 buys, 3 holds, 2 sells previously: Bloomberg data

(Bloomberg) -- Maybank Kim Eng analyst Rahmi Marina raised the recommendation on Bank Danamon Indonesia Tbk PT to buy from hold.

- PT set to IDR5,000, implies a 48% increase from last price. Bank Danamon average PT is IDR4,582.09.

- Targets range from IDR3,600 to IDR9,000

- Bank Danamon had 8 buys, 4 holds, 0 sells previously: Bloomberg data

- Bank Danamon reported earnings that topped estimates for the quarter on Feb. 19

Indo Tambangraya Raised to Hold at Maybank; PT IDR10,200

(Bloomberg) -- Maybank Kim Eng analyst Isnaputra Iskandar raised the recommendation on Indo Tambangraya Megah Tbk PT to hold from sell.

- PT set to IDR10,200, implies a 7.3% decrease from last price. Indo Tambangraya average PT is IDR13,079.29.

- Targets range from IDR9,600 to IDR35,700

- Indo Tambangraya had 8 buys, 8 holds, 3 sells previously: Bloomberg data

- Indo Tambangraya reported earnings that trailed estimates for the quarter on Feb. 21.

Indosat Raised to Buy at DBS Bank; PT IDR3,200

(Bloomberg) -- DBS Bank analyst Sachin Mittal raised the recommendation on Indosat Tbk PT to buy from fully valued.

- PT set to IDR3,200, implies a 45% increase from last price. Indosat average PT is IDR3,520.53.

- Targets range from IDR1,400 to IDR7,000

- Indosat had 19 buys, 5 holds, 5 sells previously: Bloomberg data

- Indosat reported sales that topped estimates for the quarter on Feb. 24.

Bank Central Asia May See Slower Profit Growth: Company Outlook

Palm Oil Stays in Bear Market Even After Mild Gains on Petroleum

ASIA COAL: China Futures Extend Retreat as Supply Seen Building

(Bloomberg) -- Thermal coal for May delivery -0.4% to 546.4 yuan/ton on Zhengzhou Commodity Exchange at 10:55am local time, extending drop toward lowest close since Jan. 23.

Kinerja IHSG kian merosof, hari ini break below 5.843 (sesuai prediksi CTASaham 3-10 Feb IHSG is not bottoming). Now CTASaham memberikan 3 saham dividen (BBRI BMRI BBNI) + sektor; saham Oversold LSIP MEDC UNTR UNVR: BUY near supports (Red Lines) or BUY if breakout resists (Green Lines), stop below red lines (- 3% - 5%).

*USD/IDR JUMPS 0.8% TO 13,869, BIGGEST GAIN SINCE AUGUST 2019

Indosat Full Year Net Income 1.57 Trln Rupiah

(Bloomberg) -- Indosat reported net income for the full year of 1.57 trillion rupiah vs. loss 2.40 trillion rupiah y/y.

- FY revenue 26.1 trillion rupiah, +13% y/y

- FY EPS 289 rupiah

NOTE:

- 17 buys, 6 holds, 6 sells

- FY revenue 26.1 trillion rupiah, +13% y/y

- FY EPS 289 rupiah

- 17 buys, 6 holds, 6 sells

Turun terus, performa IHSG paling buruk di dunia

https://m.kontan.co.id/news/turun-terus-performa-ihsg-paling-buruk-di-dunia

Proyeksi IHSG Pekan Depan: Melemah di Awal, Berpeluang Rebound di Akhir

https://m.bisnis.com/market/read/20200222/7/1204574/proyeksi-ihsg-pekan-depan-melemah-di-awal-berpeluang-rebound-di-akhir

"Week Ahead: Gold, Bonds, Volatility To Rise Further As Virus Jitters Build"

http://www.investing.com/analysis/week-ahead-gold-bonds-volatility-to-rise-further-as-virus-jitters--build-200509860

Termasuk Corona, Ini Sentimen Pasar Keuangan di Pekan Depan

https://www.cnbcindonesia.com/market/20200223204835-17-139917/termasuk-corona-ini-sentimen-pasar-keuangan-di-pekan-depan

Selama Sepekan Saham Ini Naik Hingga 178%

https://www.cnbcindonesia.com/market/20200223184322-17-139911/selama-sepekan-saham-ini-naik-hingga-178

Top! IHSG Cetak Penguatan Saat Bursa Utama Asia Berguguran

https://www.cnbcindonesia.com/market/20200222130647-17-139795/top-ihsg-cetak-penguatan-saat-bursa-utama-asia-berguguran

IHSG merosot 6,62% sejak awal tahun, simak saham-saham pilihan berikut

https://m.kontan.co.id/news/ihsg-merosot-662-sejak-awal-tahun-simak-saham-saham-pilihan-berikut

IHSG Sepekan: Ini 10 Saham Top Gainers pada 17-21 Februari 2020

https://m.bisnis.com/market/read/20200222/7/1204630/ihsg-sepekan-ini-10-saham-top-gainers-pada-17-21-februari-2020

10 Saham Paling Dicari Investor Asing, 21 Februari 2020

https://m.bisnis.com/market/read/20200221/7/1204458/10-saham-paling-dicari-investor-asing-21-februari-2020

Sepekan Meroket 3,7%, Emas Dunia Siap Cetak Rekor Tertinggi?

https://www.cnbcindonesia.com/market/20200222120518-17-139787/sepekan-meroket-37-emas-dunia-siap-cetak-rekor-tertinggi

Speculators positions, wave counting & sentiment are supported gold & USD index. Watch GBPUSD USDJPY on cup with handle. Gold is overbought & fragile for profit taking if above $ 1.660, swing target $ 1,700-$1,8XX.

Saham Global Rontok, IHSG Terjungkal 1 Persen

https://market.bisnis.com/read/20200221/7/1204372/saham-global-rontok-ihsg-terjungkal-lebih-dari-1-persen?utm_source=dlvr.it&utm_medium=twitter

Bank Mandiri (BMRI) bakal tebar dividen Rp 16,49 triliun, simak jadwalnya

https://investasi.kontan.co.id/news/bank-mandiri-bmri-bakal-tebar-dividen-rp-1649-triliun-simak-jadwalnya

Catat, ini jadwal pembagian dividen Bank Rakyat Indonesia (BBRI)

https://investasi.kontan.co.id/news/catat-ini-jadwal-pembagian-dividen-bank-rakyat-indonesia-bbri

"Tiga Bank BUMN Tebar Dividen, Pemerintah Kantongi Rp 24 Triliun" , https://katadata.co.id/berita/2020/02/21/tiga-bank-bumn-tebar-dividen-pemerintah-kantongi-rp-24-triliun

Erick Thohir Minta Telkom Harus Beri Dividen Lebih Besar

https://www.cnbcindonesia.com/market/20200221163606-17-139655/erick-thohir-minta-telkom-harus-beri-dividen-lebih-besar?utm_source=twitter&utm_medium=oa&utm_content=cnbcindonesia&utm_campaign=cmssocmed

BEI perpanjang suspensi tujuh emiten, siapa saja?

https://investasi.kontan.co.id/news/bei-perpanjang-suspensi-tujuh-emiten-siapa-saja

Melalui Buku, Orang Ini Ramalkan Corona Pertama Kali?

https://www.cnbcindonesia.com/lifestyle/20200221162352-33-139649/melalui-buku-orang-ini-ramalkan-corona-pertama-kali?utm_source=twitter&utm_medium=oa&utm_content=cnbcindonesia&utm_campaign=cmssocmed

"Membongkar Modus Operandi Mafia Pooling Saham"

Read more at: https://investor.id/opinion/membongkar-modus-operandi-mafia-pooling-saham

Pendapatan 2019 tergerus, laba bersih Indo Tambangraya (ITMG) anjlok hingga 50%

https://investasi.kontan.co.id/news/pendapatan-tergerus-laba-bersih-indo-tambangraya-itmg-anjlok-hingga-50

Live Update 20 - 21 Feb (IG Story WA Facebook)

Bank Indonesia pangkas suku bunga acuan, IHSG di tutup hijau

https://lnkd.in/f_xG5QA Suku bunga BI turun, ini dampaknya ke sektor properti https://lnkd.in/ffbvsDm BI Sebut Virus Corona Bisa Bikin Devisa RI Menguap US$ 1,3 M https://lnkd.in/fAiX9M5

IHSG sukses bertahan menguat di 5.935,434 pada sesi I perdagangan, Kamis (20/2)

https://investasi.kontan.co.id/news/ihsg-sukses-bertahan-menguat-di-5935434-pada-sesi-i-perdagangan-kamis-202

IHSG reli tiga hari, ini saham-saham LQ45 yang berhari-hari terus naik

https://investasi.kontan.co.id/news/ihsg-reli-tiga-hari-ini-saham-saham-lq45-yang-berhari-hari-terus-naik

IHSG mendaki, berikut saham LQ45 yang turun lima hari dan tiga hari berturut

https://investasi.kontan.co.id/news/ihsg-mendaki-berikut-saham-lq45-yang-turun-lima-hari-dan-tiga-hari-berturut

Musim bagi dividen dimulai, lihat lagi para penghuni IDX High Dividend 20

Rupiah Terpuruk! Dekati Rp 13.800/US$, Ada Apa Ini?

(Bloomberg) -- Maybank Kim Eng analyst Rahmi Marina cut the recommendation on Bank Tabungan Negara Persero Tbk PT to sell from hold.

- PT set to IDR1,700, implies a 10% decrease from last price. Bank Tabungan Negara average PT is IDR2,162.18.

- Targets range from IDR1,450 to IDR4,200

- Bank Tabungan Negara had 13 buys, 6 holds, 3 sells previously: Bloomberg data

- Bank Tabungan Negara reported earnings that trailed estimates for the quarter on Feb. 15.

ASIA COAL: China Futures Hold Declines as Supply Seen Climbing

(Bloomberg) -- Thermal coal for May delivery little changed at 551.8 yuan/ton on Zhengzhou Commodity Exchange as of 11:22am local time, near the lowest level since Jan. 23.

- Futures -1.6% so far this week

- “Mine resumption is gradually increasing, easing the tight supply situation,” Nanhua Futures said in a note

- In terms of demand, daily consumption is slowly recovering while power plant inventories remain high, Nanhua added

- NOTE: Daily coal use by nation’s six major coastal utilities jumped 7% Thursday to 421,400 tons, according to CCTD data

- Australian Newcastle coal futures for April -1% to $67.70/ton on Wednesday, lowest in more than two weeks

- NOTE: Zhengzhou contract is based on coal with calorific value of 5,500 kcal/kg; Newcastle is 6,000 kcal/kg

- Futures -1.6% so far this week

- “Mine resumption is gradually increasing, easing the tight supply situation,” Nanhua Futures said in a note

- In terms of demand, daily consumption is slowly recovering while power plant inventories remain high, Nanhua added

- NOTE: Daily coal use by nation’s six major coastal utilities jumped 7% Thursday to 421,400 tons, according to CCTD data

- Australian Newcastle coal futures for April -1% to $67.70/ton on Wednesday, lowest in more than two weeks

- NOTE: Zhengzhou contract is based on coal with calorific value of 5,500 kcal/kg; Newcastle is 6,000 kcal/kg

PALM OIL: Futures Hit 3-Month Low With Sentiment ‘Badly Dented

Prices Palm oil for May delivery on Bursa Malaysia Derivatives drop as much as 1.2% to 2,516 ringgit per ton, lowest intraday for most active contract since Nov. 5 Futures at 2,521 ringgit by the midday break in Kuala Lumpur

Adaro Energy Raised to Hold at Maybank; PT IDR1,380

(Bloomberg) -- Maybank Kim Eng analyst Isnaputra Iskandar raised the recommendation on Adaro Energy Tbk PT to hold from sell.

- PT set to IDR1,380, implies a 3% increase from last price. Adaro Energy average PT is IDR1,530.47.

- Targets range from IDR812 to IDR2,410

- Adaro Energy had 12 buys, 11 hold, 3 sells previously: Bloomberg data

Mayora Indah’s PT Lowered at CIMB on Growing Competition

(Bloomberg) -- The company may post disappointing sales this year on intensifying competition in coffee markets with the Philippines, as well as the slowdown in China’s economic growth led by the coronavirus, according to CGS-CIMB Sekuritas in a report.

- Forecast for 2020 sales growth revised to 4% from 6%, analyst Patricia Gabriela writes in the report

- The brokerage expects sustained margins and lower operations expenditure to buffer earnings downside

- Slower earnings growth seen as downside risk, while higher-than-expected sales growth is an upside

- Maintains hold recommendation, PT cut to 2,100 rupiah from 2,300 rupiah

- Forecast for 2020 sales growth revised to 4% from 6%, analyst Patricia Gabriela writes in the report

- The brokerage expects sustained margins and lower operations expenditure to buffer earnings downside

- Slower earnings growth seen as downside risk, while higher-than-expected sales growth is an upside

- Maintains hold recommendation, PT cut to 2,100 rupiah from 2,300 rupiah

Bumi Serpong Raised to Outperform at Macquarie; PT IDR1,520

(Bloomberg) -- Macquarie analyst Richard Danusaputra raised the recommendation on Bumi Serpong Damai Tbk PT to outperform from neutral.

- PT set to IDR1,520, implies a 31% increase from last price. Bumi Serpong average PT is IDR1,622.35.

- Targets range from IDR1,100 to IDR2,190

- Bumi Serpong had 20 buys, 6 holds, 1 sell previously: Bloomberg data

- PT set to IDR1,520, implies a 31% increase from last price. Bumi Serpong average PT is IDR1,622.35.

- Targets range from IDR1,100 to IDR2,190

- Bumi Serpong had 20 buys, 6 holds, 1 sell previously: Bloomberg data

Summarecon Agung Raised to Neutral at Macquarie; PT IDR940

(Bloomberg) -- Macquarie analyst Richard Danusaputra raised the recommendation on Summarecon Agung Tbk PT to neutral from underperform.

- PT set to IDR940, implies a 0.5% increase from last price. Summarecon Agung average PT is IDR1,312.40.

- Targets range from IDR880 to IDR1,650

- Summarecon Agung had 19 buys, 6 holds, 1 sell previously: Bloomberg data

- PT set to IDR940, implies a 0.5% increase from last price. Summarecon Agung average PT is IDR1,312.40.

- Targets range from IDR880 to IDR1,650

- Summarecon Agung had 19 buys, 6 holds, 1 sell previously: Bloomberg data

Indofood CBP Cut to Hold at Ciptadana; PT IDR11,825

(Bloomberg) -- Ciptadana Sekuritas analyst Muhammad Fariz cut the recommendation on Indofood CBP Sukses Makmur Tbk PT to hold from buy.

- PT set to IDR11,825, implies a 8.7% increase from last price. Indofood CBP average PT is IDR12,456.59.

- Targets range from IDR9,300 to IDR13,800

- Indofood CBP had 18 buys, 11 hold, 2 sells previously: Bloomberg data

- PT set to IDR11,825, implies a 8.7% increase from last price. Indofood CBP average PT is IDR12,456.59.

- Targets range from IDR9,300 to IDR13,800

- Indofood CBP had 18 buys, 11 hold, 2 sells previously: Bloomberg data

Indofood Sukses Rated New Buy at Mirae Asset Daewoo

(Bloomberg) -- Mirae Asset Daewoo Co.,Ltd. initiated coverage of Indofood Sukses Makmur Tbk PT with a recommendation of buy.

- PT set to IDR9,500, implies a 34% increase from last price. Indofood Sukses average PT is IDR9,331.05.

- Targets range from IDR7,300 to IDR10,500

- Indofood Sukses had 25 buys, 2 holds, 0 sells previously: Bloomberg data

Bank Tabungan Negara Raised to Buy at BCA Sekuritas

(Bloomberg) -- BCA Sekuritas analyst Tirta Ng raised the recommendation on Bank Tabungan Negara Persero Tbk PT to buy from hold.

- PT set to IDR2,000, implies a 12% increase from last price. Bank Tabungan Negara average PT is IDR2,275.47.

- Targets range from IDR1,450 to IDR4,200

- Bank Tabungan Negara had 12 buys, 7 holds, 1 sell previously: Bloomberg data

- Bank Tabungan Negara reported earnings that trailed estimates for the quarter on Feb. 15.

Adaro Energy’s 2019 Coal Sales Rise 9% Y/y to 59.18 Million Tons

(Bloomberg) -- Coal sales increased from 54.39m tons in 2018, the Indonesian coal miner says in stock exchange filing.

- 4Q coal sales fell 4% Y/y to 14.52m tons

- 2019 coal production climbed 7% Y/y to 58.03m tons

- 4Q coal output was down 8% Y/y to 13.91m tons

- Southeast Asia accounted for most sales with 42% of total last year, followed by East Asia excluding China and India

- China made up for 12% of total sales

- Blended strip ratio for 2019 was 4.69 times, slightly higher than guidance of 4.56 times

- Co. sees 2020 production at 54m-58m tons, operational EBITDA at $900m-$1.2b

- Co. sets aside $300m-$400m as capital expenditure this year

(Bloomberg) -- Mirae Asset Daewoo Co.,Ltd. initiated coverage of Indofood Sukses Makmur Tbk PT with a recommendation of buy.

- PT set to IDR9,500, implies a 34% increase from last price. Indofood Sukses average PT is IDR9,331.05.

- Targets range from IDR7,300 to IDR10,500

- Indofood Sukses had 25 buys, 2 holds, 0 sells previously: Bloomberg data

Bank Tabungan Negara Raised to Buy at BCA Sekuritas

(Bloomberg) -- BCA Sekuritas analyst Tirta Ng raised the recommendation on Bank Tabungan Negara Persero Tbk PT to buy from hold.

- PT set to IDR2,000, implies a 12% increase from last price. Bank Tabungan Negara average PT is IDR2,275.47.

- Targets range from IDR1,450 to IDR4,200

- Bank Tabungan Negara had 12 buys, 7 holds, 1 sell previously: Bloomberg data

- Bank Tabungan Negara reported earnings that trailed estimates for the quarter on Feb. 15.

Adaro Energy’s 2019 Coal Sales Rise 9% Y/y to 59.18 Million Tons

(Bloomberg) -- Coal sales increased from 54.39m tons in 2018, the Indonesian coal miner says in stock exchange filing.

- 4Q coal sales fell 4% Y/y to 14.52m tons

- 2019 coal production climbed 7% Y/y to 58.03m tons

- 4Q coal output was down 8% Y/y to 13.91m tons

- Southeast Asia accounted for most sales with 42% of total last year, followed by East Asia excluding China and India

- China made up for 12% of total sales

- Blended strip ratio for 2019 was 4.69 times, slightly higher than guidance of 4.56 times

- Co. sees 2020 production at 54m-58m tons, operational EBITDA at $900m-$1.2b

- Co. sets aside $300m-$400m as capital expenditure this year

Indonesia’s Jan. Exports Fall 3.71% Y/y; Trade in $870M Deficit

(Bloomberg) -- Jan. trade deficit was $870m, according to Bloomberg calculations based on data from the statistics office; est. $375m deficit.

- Exports fell 3.71% Y/y to $13.41b; est. +1.19% Y/y

- Imports fell 4.78% Y/y to $14.28b; est. -4.75% Y/y

- Exports fell 3.71% Y/y to $13.41b; est. +1.19% Y/y

- Imports fell 4.78% Y/y to $14.28b; est. -4.75% Y/y

Kapan saat yang tepat menjual saham? Ikuti 4 petunjuk ini

Week Ahead: Equity Volatility To Fluctuate Amid Record-Highs, Virus Fears

Economic Calendar - Top 5 Things to Watch This Week

Ini dia tiga saham big cap dengan kenaikan market cap tertinggi di pekan lalu

Laba BTN 2019 Jatuh 92% Jadi Rp 209 M, Ada Apa?

Even in a Bear Market, You Can Still Get Rich!

12 rules dari CTASAHAM, telah terbukti mendikteksi bottom reversal di saham Indonesia: tahun 2011, 2013, 2015, 2018, 2019 & warning top reversal 2020 (sebelum terjadi heboh virus Corona). Untuk lebih detail dapat join membership CTASaham & ikuti seminar VIP & VVIP CTASaham di tahun 2020.

ASIA COAL: China Futures Extend Slide on Muted Industrial Demand

(Bloomberg) -- Thermal coal for May delivery -1.2% to 554 yuan/ton on Zhengzhou Commodity Exchange as of 10:34am local time, poised for biggest one-day loss since December.

IHSG anomali dengan pergerakan indeks DJI A.S, dimana penguatan dolar, penjualan saham oleh sejumlah manajer investasi, coronavirus dear hingga bad astrocycle (10 Feb), mendukung IHSG belum bottoming (lihat artikel 3 Feb). IHSG cetak -2.18%, foreign buy Rp 718 miliar di pekan ini. IHSG masih terjaga odi atas 3 support line di kisaran 5.730-5.750, potensi bentuk pola H&S. BOW sector di Basic Industry, Banking, Consumer, Trade, Commodity. What next? Hanya ada di CTASaham. Good luck & happy trading profit all.- Futures are falling for fourth consecutive session; -0.9% last week

- Daily coal consumption by major power plants has remained below 400k tons amid delays in industrial production restarts, China Coal Transport & Distribution Association said in a note

- Earlier: Most China Commodity-Related Firms Yet to Restart, Survey Shows

- Meanwhile coal miners are resuming and ramping up output, with 64% of capacity having restarted as of Feb. 13, according to China’s official Xinhua News Agency

- Australian Newcastle coal futures for April +0.1% to $70.55/ton on Friday; most-active contract +0.9% last week

- NOTE: Zhengzhou contract is based on coal with calorific value of 5,500 kcal/kg; Newcastle is 6,000 kcal/kg

- Thermal coal news:

- China Customs Speeds Up Clearance of Soy, Coal and Other Goods

- Goldman Keeps Coal Price Forecast as Virus Hurts Supply, Demand

United Tractors Raised to Neutral at Goldman; PT IDR19,800

(Bloomberg) -- Goldman Sachs analyst Pramod Kumar raised the recommendation on United Tractors Tbk PT to neutral from sell.

- PT set to IDR19,800, implies a 8% increase from last price. United Tractors average PT is IDR24,909.09.

- Targets range from IDR18,600 to IDR35,000

- United Tractors had 19 buys, 10 holds, 3 sells previously: Bloomberg data

Indosat Raised to Buy at Ciptadana; PT IDR2,950

(Bloomberg) -- Ciptadana Sekuritas analyst Gani Gani raised the recommendation on Indosat Tbk PT to buy from sell.

- PT set to IDR2,950, implies a 40% increase from last price. Indosat average PT is IDR3,679.33.

- Targets range from IDR1,400 to IDR7,000

- Indosat had 17 buys, 6 holds, 5 sells previously: Bloomberg data

Indonesia’s Equities Face Strong Headwinds Even Without Virus

(Bloomberg) -- Indonesian stocks look set to continue underperforming regional peers even as the country remains free of reported coronavirus-linked infections. The Jakarta Composite index is down 6.9% YTD, and there appear to be few catalysts for a rebound. The virus outbreak is threatening tourism and consumption, while skyrocketing palm oil prices hurt exports, exacerbating economic growth concerns. The country struggled over the past few years thanks to a double whammy of declining demand for commodities and as U.S.-China trade tensions sapped global business confidence and slowed investment. President Joko Widodo’s plans to spend big on development projects also failed to prop up economic data, while inadequate existing infrastructure and tight labor laws limited Indonesia’s capacity to benefit from the shift in manufacturing bases spurred by the tariff wars. A crackdown on investments by insurance companies in illiquid stocks and the increased weighting for Chinese shares in MSCI indexes have also taken a toll on Indonesian stocks. That’s why JCI only eked out a 1.7% gain for 2019, a smidgen compared to the 16% surge for the MSCI Asia Pacific Index. As economic and regulatory problems persist, equity investors will have little reason to cheer in 2020 even if Indonesia defies the skeptics and continues to avoid coronavirus infections. To contact the reporter on this story: Ishika Mookerjee in Singapore at imookerjee@bloomberg.net

Gudang Garam Raised to Buy at Trimegah Securities; PT IDR70,000

(Bloomberg) -- Trimegah Securities Tbk PT analyst Heribertus Ariando raised the recommendation on Gudang Garam Tbk PT to buy from neutral.

- PT set to IDR70,000, implies a 29% increase from last price. Gudang Garam average PT is IDR59,325.

- Targets range from IDR47,700 to IDR99,000

- Gudang Garam had 21 buy, 9 holds, 3 sells previously: Bloomberg data

IHSG turun 2,21% dalam sepekan ke 5.866,94

https://investasi.kontan.co.id/news/ihsg-turun-221-dalam-sepekan-ke-586694

Jelang Akhir Pekan, IHSG Melemah Tipis di 5.867

https://economy.okezone.com/read/2020/02/14/278/2168517/jelang-akhir-pekan-ihsg-melemah-tipis-di-5-867

Menuju Era Baru "Hilirisasi Hijau" Batu Bara

https://www.cnbcindonesia.com/news/20200212175643-16-137427/menuju-era-baru-hilirisasi-hijau-batu-bara?utm_source=twitter&utm_medium=oa&utm_content=cnbcindonesia&utm_campaign=cmssocmed

"Analis Sebut Tak Ada Hubungannya Virus Corona dengan Laju Indeks Saham" ,

https://katadata.co.id/berita/2020/02/11/analis-sebut-tak-ada-hubungannya-virus-corona-dengan-laju-indeks-saham

"BEI Sebut Pemblokiran 800 Rekening Efek Tidak Berdampak pada IHSG" ,

https://katadata.co.id/berita/2020/02/14/bei-sebut-pemblokiran-800-rekening-efek-tidak-berdampak-pada-ihsg

Update Polling CNBC Indonesia

Neraca Perdagangan Januari Diramal Tekor US$ 78,5 Juta

https://www.cnbcindonesia.com/news/20200214093252-4-137847/neraca-perdagangan-januari-diramal-tekor-us--785-juta

Siap-siap, 17 Februari Pemerintah uji coba blokir ponsel ilegal via IMEI

https://industri.kontan.co.id/news/siap-siap-17-februari-pemerintah-uji-coba-blokir-ponsel-ilegal-via-imei

Indonesia Sets Chicken Reference Prices to Curb Fluctuations

(Bloomberg) -- Govt sets price range at 8,000 rupiah to 10,000 rupiah per day-old chick to ensure affordable price for small-scale poultry farmers, according to recent rule issued by Trade Ministry.

Elnusa Reinstated Buy at BNI Securities; PT IDR330- Govt also sets reference price for 20-week-old chicks at 90,000 rupiah each

- Policy taken as prices often fluctuate and disturb supply, says Suhanto, director general of domestic trade at the ministry, in text message on Thursday

- Price range for eggs at farmers’ level revised to 19,000-21,000 rupiah per kilogram from previously 18,000-20,000 rupiah

- Rule effective from Feb. 10

Indofood CBP Cut to Hold at CIMB; PT IDR11,000

(Bloomberg) -- CIMB analyst Patricia Gabriela cut the recommendation on Indofood CBP Sukses Makmur Tbk PT to hold from add.

- PT set to IDR11,000, implies a 2.3% increase from last price. Indofood CBP average PT is IDR12,506.32.

- Targets range from IDR9,300 to IDR13,800

- Indofood CBP had 19 buys, 10 holds, 2 sells previously: Bloomberg data

(Bloomberg) -- BNI Securities reinstated coverage of Elnusa Tbk PT with a recommendation of buy.

Lion Air Pushes Back IPO to 2Q on Coronavirus Outbreak, IFR Says- PT set to IDR330, implies a 32% increase from last price. Elnusa average PT is IDR420.

- Targets range from IDR210 to IDR625

- Elnusa had 5 buys, 0 holds, 0 sells previously: Bloomberg data

(Bloomberg) -- Indonesian airline delayed its proposed IPO of as much as $800m to the second quarter due to the coronavirus outbreak, IFR reports, citing unidentified people close to the transaction.

Palm Oil Imports by Biggest Buyer Plummet to 18-Month Low: Chart- Lion Mentari, the owner of Lion Air, had previously targeted completing the IPO in the current quarter

- READ: In Jan., Lion Air Starts Gauging IPO Demand From Next Week: Terms

Kabar Gembira Nih Pak Jokowi! CAD 2019 Menyusut ke 2,72% PDB

https://www.cnbcindonesia.com/news/20200210102031-4-136545/kabar-gembira-nih-pak-jokowi-cad-2019-menyusut-ke-272-pdb?utm_source=notifikasi&utm_campaign=browser&utm_medium=desktop

Week Ahead: After Strong Stock Action, Virus Selloff Sends Bearish Signals

https://www.investing.com/analysis/week-ahead-after-strong-stock-action-virus-selloff-sends-bearish-signals-200505919

Ini Lima Sentimen Penting yang Dipantau Pasar Pekan Depan

https://www.cnbcindonesia.com/market/20200209205611-17-136489/ini-lima-sentimen-penting-yang-dipantau-pasar-pekan-depan

Saham Rokok, Antara Korona dan Cukai Naik

https://analisis.kontan.co.id/news/saham-rokok-antara-korona-dan-cukai-naik

Cadangan Devisa Naik, Begini Respons ke Saham Bank BUKU IV

http://detik.id/60vp5F

Virus Corona Serang Bursa Saham China, Rp 5.800 T Menguap

https://www.cnbcindonesia.com/market/20200208121911-17-136331/virus-corona-serang-bursa-saham-china-rp-5800-t-menguap?utm_source=twitter&utm_medium=oa&utm_content=cnbcindonesia&utm_campaign=cmssocmed

Top Losers 20 Saham Paling Rugi Tahun 2020

https://pusatis.com/2020/02/10/top-losers-20-saham-paling-rugi-tahun-2020/

Sudah Anjlok 17%, Harga Minyak Mentah Masih Tertekan

https://www.cnbcindonesia.com/market/20200210100817-17-136540/sudah-anjlok-17-harga-minyak-mentah-masih-tertekan?utm_source=twitter&utm_medium=oa&utm_content=cnbcindonesia&utm_campaign=cmssocmed

2020 to be pivotal for coal miners — report

https://www.mining.com/2020-to-be-pivotal-for-coal-miners-report/

Antam Raised to Buy at Sucor Sekuritas; PT IDR1,000

(Bloomberg) -- Sucor Sekuritas analyst Hasan Barakwan raised the recommendation on Aneka Tambang Tbk to buy from hold.

PT set to IDR1,000, implies a 37% increase from last price. Antam average PT is IDR1,088.13.

Targets range from IDR950 to IDR1,365

Antam had 15 buys, 0 holds, 0 sells previously: Bloomberg data

XL Axiata Full Year Net Income 712.58 Bln Rupiah

(Bloomberg) -- XL Axiata reported net income for the full year of 712.58 billion rupiah vs. loss 3.30 trillion rupiah y/y.

FY revenue 25.13 trillion rupiah, +9.7% y/y

FY EPS 67 rupiah vs. loss/share 308 rupiah y/y

NOTE:

30 buys, 2 holds, 0 sells

Cadangan Devisa RI Tertinggi Sepanjang Sejarah, Karena Utang

Kalbe Farma Raised to Buy at Ciptadana; PT IDR1,790

(Bloomberg) -- Ciptadana Sekuritas analyst Robert Sebastian raised the recommendation on Kalbe Farma Tbk PT to buy from hold.

- PT set to IDR1,790, implies a 23% increase from last price. Kalbe Farma average PT is IDR1,703.16.

- Targets range from IDR1,200 to IDR2,000

- Kalbe Farma had 16 buys, 7 holds, 4 sells previously: Bloomberg data

- PT set to IDR1,790, implies a 23% increase from last price. Kalbe Farma average PT is IDR1,703.16.

- Targets range from IDR1,200 to IDR2,000

- Kalbe Farma had 16 buys, 7 holds, 4 sells previously: Bloomberg data

IHSG mengayun, cek 20 saham LQ45 dengan PER terendah dan tertinggi (6/2)

(Bloomberg) -- Palm oil inventories in Malaysia probably contracted to their lowest in two and a half years in January as output in the world’s second-largest producer nosedived to the weakest since 2016.

- Palm oil for April delivery on Bursa Malaysia Derivatives +1.6% to 2,850 ringgit/ton on Thursday

- Most-active contract +8.2% so far this week

Indonesia

- Global funds sold a net $131.1 million in Indonesian bonds on Feb. 5, according to finance ministry data

- Bought a net $21.6 million in country's equities on Feb. 6, according to exchange data

* Kompas 100*

*Baru Masuk :* *ASSA*, BOGA, JRPT, MDKA, MGRO, MTDL, SIDO, SILO, SMCB, SPTO, TDPM, TELE

*Keluar :* ASRI, BDMN, BHIT, BRIS, BUMI, BWPT, DOID, GJTL, IMAS, KREN, LINK, TBLA

Credit Suisse: Tiga Saham Ini Semakin Seksi Setelah Koreksi!

China to cut tariffs in half on $75 billion of U.S. goods

3 Alasan Corona Lebih Menakutkan Bagi Pasar Dibanding SARS

https://www.cnbcindonesia.com/

WELL DONE Terbukti Lagi: prediksi CTASaham dari bad cycle (14-27 Jan) IHSG hit low 6.877. Pekan ini good cycle "Bottom fishing IHSG awal pekan ini" (artikel 3 Feb). TOP 3: BTPS ADRO PTBA, BBRI BBCA naik tipis; TLKM PGAS terkoreksi. What next? Hanya ada di CTASaham.

Bottom fishing IHSG awal pekan & Februari ini, karena technical oversold & oversold, astrocycle membaik & isu Corona virus akan mereda di pekan ini, meski belum bottoming sesuai warning CTASaham untuk outlook 2020.

Masih soal Corona ini sentimen pengerak pasar pekan depan

https://www.cnbcindonesia.com/market/20200202164759-17-134590/masih-soal-corona-ini-sentimen-penggerak-pasar-pekan-depan?utm_source=notifikasi&utm_campaign=browser&utm_medium=mobile&fbclid=IwAR3XknN14TuX3d1lcBrVqQeE9f6Rg401odfA4zjXa9JnLgrz3j_m9TMkmPo

https://www.cnbcindonesia.com/market/20200202164759-17-134590/masih-soal-corona-ini-sentimen-penggerak-pasar-pekan-depan?utm_source=notifikasi&utm_campaign=browser&utm_medium=mobile&fbclid=IwAR3XknN14TuX3d1lcBrVqQeE9f6Rg401odfA4zjXa9JnLgrz3j_m9TMkmPo

Musim Laporan keuangan IHSG Pada Bulan Februari Diprediksi Rebound

https://m.kontan.co.id/news/musim-laporan-keuangan-ihsg-pada-bulan-februari-diprediksi-rebound?fbclid=IwAR2fkCuVZrk5p1mw20nG7NBymMm8UvTLu6-Ss-qZvP_pAYBfdW7ekUDhrDA

https://m.kontan.co.id/news/musim-laporan-keuangan-ihsg-pada-bulan-februari-diprediksi-rebound?fbclid=IwAR2fkCuVZrk5p1mw20nG7NBymMm8UvTLu6-Ss-qZvP_pAYBfdW7ekUDhrDA

IHSG berpeluang rebound ini rekomendasi saham awal pekan depan https://m.bisnis.com/https://market.bisnis.com/read/20200201/7/1196265/ihsg-berpeluang-rebound-ini-rekomendasi-saham-awal-pekan-depan

Tenang IHSG pernah anjlok 10% kok, ini catatan https://www.cnbcindonesia.com/market/20190514141623-17-72394/tenang-ihsg-pernah-anjlok-10-kok-ini-catatan-sejarahnya?fbclid=IwAR1zCE9Of83xq3evxeSB62Qik0vzdKnujUYjQF1hjAxLxn-BAVle9ON-12c

Anjlok! IHSG Bisa-Bisa Meluncur ke Level 5.847 Minggu Depan

https://www.cnbcindonesia.com/market/20200131204550-17-134414/anjlok-ihsg-bisa-bisa-meluncur-ke-level-5847-minggu-depan?fbclid=IwAR3WyV2xlCFk9VIr3DJE9zcY3H288YcUsYoMHEStACA-h0BOXUfhsTs3Hz0

https://www.cnbcindonesia.com/market/20200131204550-17-134414/anjlok-ihsg-bisa-bisa-meluncur-ke-level-5847-minggu-depan?fbclid=IwAR3WyV2xlCFk9VIr3DJE9zcY3H288YcUsYoMHEStACA-h0BOXUfhsTs3Hz0

Week ahead volatility to increase as virus fears excelerate havens rise

https://m.investing.com/analysis/week-ahead-volatility-to-increase-as-virus-fears-excelerate-havens-rise-200503806?fbclid=IwAR264Fr2LgwLlKPGfaDIunzN_3y2YiReMeMR-1_2g6FILBrMwVJLkq8p03M

https://m.investing.com/analysis/week-ahead-volatility-to-increase-as-virus-fears-excelerate-havens-rise-200503806?fbclid=IwAR264Fr2LgwLlKPGfaDIunzN_3y2YiReMeMR-1_2g6FILBrMwVJLkq8p03M

Analis: pasar saham baru bangkit di semester 2 tahun ini

https://m.kontan.co.id/news/ihsg-longsor-saham-emiten-kecil-dan-menengah-?fbclid=IwAR2ac5mX8xMR-vNRbhjdl5c9weG6RUmjb-hlFZAhQK7CjJhHjojNvvIV45U

https://m.kontan.co.id/news/ihsg-longsor-saham-emiten-kecil-dan-menengah-?fbclid=IwAR2ac5mX8xMR-vNRbhjdl5c9weG6RUmjb-hlFZAhQK7CjJhHjojNvvIV45U

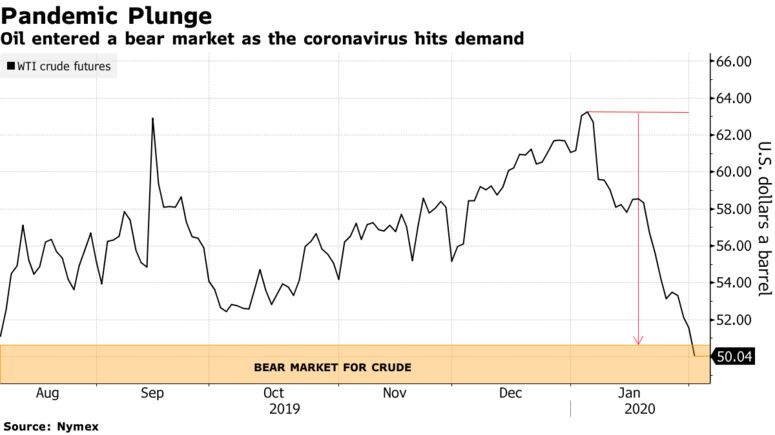

Oil extends the worst start to a year since 1991 after China’s oil consumption was said to plunge by 20% during efforts to stop the spread of coronavirus trib.al/eStVpox

(Bloomberg) -- Due to the coronavirus outbreak, the Indonesian government has tightened imports of goods from China, which could affect some retailers with high import contribution from the country, according to CGS-CIMB Securities.

- Ace Hardware Indonesia and Mitra Adiperkasa, through its subsidiary MAP Aktif, could be affected the most, though the impact should be limited as they have an inventory of 150-200 days, analyst Patricia Gabriela writes in report

- Some shopping malls in Jakarta have seen a decline in visitors volume due to general public wariness about the virus, which will jeopardize retailers’ same-store sales growth

- CIMB reiterates neutral call on retail sector as the outbreak is a temporary event, although a prolonged outbreak could disrupt consumers’ purchasing patterns and imports/exports flows

Perusahaan Gas Negara Tbk PT Cut to Neutral at Credit Suisse

(Bloomberg) -- Credit Suisse analyst Andri Ngaserin cut the recommendation on Perusahaan Gas Negara Tbk PT to neutral from outperform.

- PT set to IDR1,620, implies a 4.7% decrease from last price. Perusahaan Gas Negara Tbk PT average PT is IDR2,330.

- Targets range from IDR1,620 to IDR3,120

- Perusahaan Gas Negara Tbk PT had 10 buys, 9 holds, 3 sells previously: Bloomberg data

Indonesia May Boost Coal Exports to China Amid Virus Outbreak

(Bloomberg) -- There’s opportunity for Indonesia to increase coal exports to China as the coronavirus outbreak hinders domestic production in the world’s largest buyer, according to the Indonesian Coal Mining Association.

- The industry group will need 1-2 weeks to assess impact from the outbreak, Executive Director Hendra Sinadia said by phone

- China may need to boost coal imports if outbreak worsens and disrupts transportation from its production hubs including Inner Mongolia

- China’s import demand will depend on port conditions

- Indonesia shipped 126m tons of coal to China in Jan.- Oct. 2019 vs 113.6m tons for all of 2018

- Health ministry and port authorities in Kalimantan, Indonesia’s main coal mining region, are checking vessels and crew members that handle coal shipments to China

- READ: China Thermal Coal Jumps as Mine Closures Extended on Virus

Indonesia’s Construction Contract Growth Seen Rising: CGS-CIMB

(Bloomberg) -- Indonesia may see faster-than-expected contract disbursement in 1H after 2019 general elections delayed some projects, according to CGS-CIMB Sekuritas in a report.

- Contract growth will pick up in 2020 as it reached the bottom last year, analyst Aurelia Barus says in the report

- Increase in the budget of Transport Ministry and Public and Housing Ministry will help the growth pick up this year

- The brokerage retains overweight call for the sector

- State-run contractors Wijaya Karya, Adhi Karya and Waskita Karya are tender participants of the 18.4t rupiah Jakarta MRT phase 2 project section 2 and 3

- Project’s winner expected to be announced at end 1H or early 2H

- Top picks are PT PP on growth perspective and Waskita Karya on assets valuation

- Downside risks to come from unfavorable govt policies or intervention, lackluster earnings and failure to secure sufficient funding

Indonesia

- Global funds sold a net $176.3 million in Indonesian bonds on Jan. 31, according to finance ministry data

- Sold a net $58.9 million in country's equities on Feb. 3, according to exchange data